Michael G. Branson Edited by

Michael G. Branson Edited by  Cliff Auerswald 19 comments

Cliff Auerswald 19 commentsBy  Michael G. Branson Edited by

Michael G. Branson Edited by  Cliff Auerswald 19 comments

Cliff Auerswald 19 comments

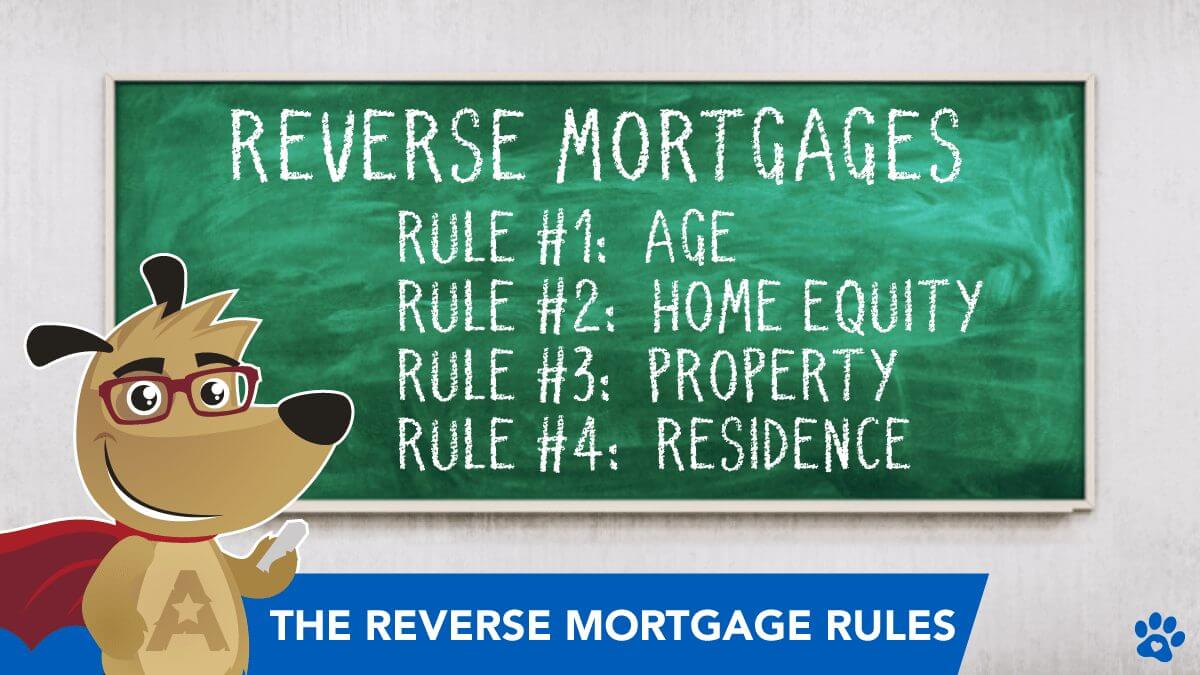

Reverse mortgages can be a helpful financial tool for many seniors, but the requirements can sometimes be a bit confusing. It’s 2024, and some requirements have changed. Knowing the current guidelines is important if you’re over 62 and considering a reverse mortgage.

That’s why we’ve compiled an easy-to-understand guide on the five basic rules for reverse mortgages. We want to ensure you have all the information you need to make the right choice.

To fully understand the ins and outs of the reverse mortgage, homeowners should remember and be aware of the following:

| Rule | Detail |

|---|---|

| Borrower Age Requirement | Borrowers must be at least 62 years old. |

| Primary Residence | The property must be the borrower's primary residence. |

| Equity Requirement | Borrowers must have substantial equity in their home (typically at least 50%). |

| Financial Assessment | Lenders conduct a financial assessment to ensure the borrower can afford taxes, insurance, and home maintenance. |

| Loan Repayment | The loan becomes due when the borrower sells the home, moves out, or passes away. |

| Counseling Requirement | Borrowers must undergo counseling from a HUD-approved agency. |

| Property Eligibility | Eligible properties include single-family homes, FHA-approved condominiums, and certain manufactured homes. |

This table provides a concise overview of the primary rules associated with reverse mortgages, including borrower age, primary residence requirements, equity requirements, financial assessments, loan repayment terms, counseling requirements, and property eligibility.

It would be nice to borrow as much money as you need, but the government limits the amount you can borrow with a reverse mortgage.

The maximum amount for a reverse mortgage, officially called a Home Equity Conversion Mortgage (HECM), is currently $1,149,825. But remember, not everyone can borrow this full amount.

The amount you can borrow depends on a few things:

These rules make sure the borrowing amount fits your situation and protects you and the lender.

Getting a reverse mortgage can greatly help your retirement planning, but first, you must complete a mandatory counseling session to ensure you understand all the details and responsibilities involved.

In the counseling session, you’ll meet with an independent counselor who will explain everything about the reverse mortgage or HECM loan. They’ll answer any questions you have about how it works and what’s involved.

You’ll learn that even after you get a reverse mortgage, you still need to keep up with certain expenses for as long as you have the loan:

You’ll also learn that you cannot have any overdue federal debts to qualify for a reverse mortgage. Some examples of federal debt include:

Once you’ve completed the counseling, you’ll receive a certificate that you need to include with your loan application. This ensures that you’ve been properly informed before you make any decisions.

To be eligible for a reverse mortgage, there are specific property requirements your home must meet.

Firstly, you should either own your home outright or have only a small mortgage left that the reverse mortgage can pay off. It’s also essential that you live in the home as your primary residence.

Now, let’s talk about what types of homes qualify:

Knowing these requirements can help you determine if your home qualifies for a reverse mortgage and if it’s a viable option for your situation.

A non-borrowing spouse (NBS) is not listed on the home title as a spouse and may be of any age. This means they aren’t legally recognized as a borrower on a Home Equity Conversion Mortgage (HECM) reverse mortgage. However, the Department of Housing and Urban Development (HUD) made changes in 2014 to offer better protection for non-borrowing spouses.

Under these guidelines, a surviving non-borrowing spouse may continue living in the home after the borrowing spouse has passed away, provided they meet certain conditions. If your spouse isn’t on the home title and you’re considering a reverse mortgage, it’s crucial to discuss this with your lender and reverse mortgage counselor.

When taking out a reverse mortgage, senior homeowners should make sure that their spouse is involved in the transaction and included in the reverse mortgage contract. This inclusion helps safeguard the spouse’s right to remain in the home should the borrowing spouse die. This proactive step is essential for ensuring that both partners are protected throughout the term of the reverse mortgage.

Homeowners considering an adjustable interest rate reverse mortgage have several payment options to choose from:

For those opting for a fixed-interest rate reverse mortgage, the payment is typically received as one lump sum. Among these options, the line of credit and tenure are particularly popular choices for homeowners, giving them flexibility in how they receive funds.

Senior homeowners looking to enhance their retirement income might find a reverse mortgage to be a valuable option. This allows them to leverage their home equity to meet financial needs during retirement.

When you have a reverse mortgage, there are critical rules you need to follow to keep the loan in good standing. These rules are clear and crucial for maintaining your loan:

Following these guidelines is not just about avoiding consequences; it’s about securing your ability to stay in your home and manage your finances in retirement.

To obtain a reverse mortgage, you must meet the minimum age requirement, which in most cases is 62. Some private reverse mortgage programs allow for borrowers as young as 55 in some but not all states. The property must be the primary residence of the borrower(s) and remain the primary residence of at least one borrower for the duration of the loan to remain in good standing. Additionally, the borrower(s) are responsible for paying their property taxes, homeowners insurance, and upkeep of the property as they would be for all other loan types.

When the last original borrower or eligible non-borrowing spouse permanently leaves home due to incapacity or death (or any other reason), the loan becomes due and payable. Borrowers or their heirs then have the right to repay the loan with funds available to them, or by refinancing the loan, they can sell the property and repay the loan with the sale proceeds, or they can walk away and owe nothing. If the borrower(s) die and heirs wish to keep the home, but the mortgage balance is greater than the value of the home, the heirs can repay the loan in full for an amount equal to the amount owed or 95% of the current value of the home, whichever is less.

California is one of the few states that impose additional time on the front end, such as the right of rescission that borrowers have on the back, which is meant to give borrowers a “cooling off” period after counseling. Lenders cannot begin processing a loan for a borrower for at least 7 days after borrowers have completed their counseling. Regardless of whether HUD will allow a returning borrower to waive counseling within 5 years, the state of California will not, and all borrowers must attend counseling for each new loan. Spouses and non-borrowing spouses must attend counseling. In the state of California, the water heater must be double strapped.

In Texas, you cannot do a loan for a non-borrowing spouse, whether eligible or non-eligible. The reverse mortgage loan must close within 180 days of counseling, or the borrower(s) must be re-counseled. The Preliminary Title Report is valid for 90 days per Texas state law. The lender must order a new, updated report if the loan does not close within that period. Texas loans cannot close with a Life Estate interest in the property. The loans in Texas also cannot close in the name of a trust. Transactions must use an attorney to review the title and closing package, which is in the state of Texas.

Florida requires the charges of transactions that can add considerably to the loan costs in that state. The state of Florida requires that each loan gets a copy of the survey or a signed survey affidavit. Florida charges additional taxes such as Intangible Taxes and Documentary Stamp Taxes. Although these are not lender fees, they are moving costs and getting new loans in Florida and must be considered.

America's #1 Rated Reverse Lender Celebrating 20 Years of Excellence. LAUNCH REVERSE MORTGAGE CALCULATOR About the Author, Michael G. Branson | Mike@allreverse.comMichael G. Branson CEO, All Reverse Mortgage, Inc. and moderator of ARLO™ has 45 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively.

Look no further. Michael G. Branson, our CEO, brings a wealth of knowledge directly to you. With a robust 45-year tenure in mortgage banking and 19 years dedicated solely to reverse mortgages, he's the expert you want on your side.

Post your question in the comments below and anticipate a personalized response from Mr. Branson himself, typically within one business day. He's here to illuminate all angles of reverse mortgages, ensuring you're equipped with the knowledge to make informed decisions. Take this opportunity to gain insights from a seasoned professional.

19 Comments on this Article| Laura August 1st, 2024 |

Thank you for taking your time to answer questions. My parents-in-law are retired and receive Medicare and Medicaid supplemental assistance in Florida. They are considering a reverse mortgage with a lump sum payout to make some improvements to the house. They will give all the money to their son, who will handle all repair work for them. The question is, if by receiving a lump sum, could they lose their supplemental assistance? Thank you in advance.

| Michael Branson August 6th, 2024 |

They can possibly endanger their eligibility for any needs-based programs if they are not careful. Medicare is typically an age-eligible program and should not be affected, but Medicaid will review their assets to determine eligibility. Loan proceeds are not considered "income," but if they have cash in their bank accounts totaling over the eligible balance, they could accidentally eliminate their eligibility.

You need to verify the eligibility requirements for the program. Most programs require the recipient to send in bank statements, and it makes no difference how much money goes through the bank account during the month. What counts is the final balance at the end of the month. If this is true for their program as well, you would need to ensure the loan proceeds were received and spent from the account within the same month, before the month-end statement is sent out. This way, the statements will show a balance that qualifies them to receive their benefits every month.

In other words, if the bank statement is printed on the last day of every month, you would want to ensure that the deposit was made after the 1st day of the month and that all the funds deposited from the loan proceeds were spent before the month-end statement was printed and sent by the bank. Both statements' ending balances will then verify an eligible balance (even though a large sum was deposited and the funds were spent).

This is much easier to do with a line of credit so that you can draw funds as needed and always keep the balance in your bank account below the amount required to remain eligible at the time the statement is printed. It can be done with the full draw as well (such as the plan you mentioned), but there is typically more money that needs to be spent in a very short time (less than 30 days). Remember, when you take the full draw, you are accruing interest on the full amount, even if you aren't using all the funds from the start, so the cost of borrowing all the money at the start is also something to consider.

| Laura August 6th, 2024 |

Thanks so much for your prompt response. This information is important and unfortunately not available, but thanks to you I got the answer I needed.

| Danny April 6th, 2024 |

My brother and his wife have a reverse mortgage on their home. His wife died in January. I began to move into their home before she died. My brother wanted me to buy into their reverse mortgage. I have plans to buy one half of his equity. We requested that the reverse mortgage be changed to include me as the owner of the house. The new reverse mortgage was approved. But, when we got notice of the closing on the mortgage, the mortgage company required $40,000 at closing. We decided to leave the original reverse mortgage in place.

| Michael Branson April 8th, 2024 |

I am afraid you need to talk to an estate attorney about this question. The loan does not dictate who gets the house when the borrower passes. Whatever you and your brother, any heirship laws of the state would determine what happens to the property. I can tell you that when he passes, the reverse mortgage will become dues and payable at that time.

This is why you need to speak to an attorney. You need to know what needs to be done so that your claim to title is secure at that time. You also need to know that to keep the home and continue living in the property, you would need to be able to refinance the loan at that time, or you would have to sell the property to pay the loan off.

As you have found, you can't just add someone to an existing reverse mortgage, and since rates are higher now and you are younger than your brother, you would need $40,000 to refinance at this time. It might be less later in a lower interest rate market or more as more interest continues to accrue on the current loan if the property does not increase substantially in value. My point is that you may be able to get a reverse mortgage on your own later to pay off the existing loan, but there is no guarantee that the interest rates and property values would support a refinance without requiring you to bring funds in to close at that time. And the manner of title and your agreement with your brother will make a difference in what happens upon his death.

| William S. September 2nd, 2022 |

My home needs considerable repairs. We owe nothing, having paid off our mortgage years ago. Needing funds from the HECM to complete those repairs, how do we achieve this considering FHA standards on the home appraisal? How can funds from a Reverse Mortgage be used to make those repairs as claimed can be done?

| Michael Branson September 6th, 2022 |

There are a few things you can do. Firstly, some repairs are required to be completed before the loan closes and some would be taken into consideration when the home is appraised and adjusted for with the final value is determined. Some repairs can have money set aside from the loan funds for their completion while others are considered a health and safety concern and must be completed before the loan may close. Finally, there are some companies who bill themselves as "FHA repair contractors" that will agree to complete FHA needed repairs knowing they will not be paid until after the loan closes. You should speak with a knowledgeable lender to determine which category your repairs fall into.

Sometimes there is no way to know for sure until after the appraiser completes the inspection. If you do choose to go the last route with the FHA contractor, be certain you shop around. Your contract with the repair company is between you and the repairman and the lender is not part of that contract. If there are any disputes later because of the workmanship, etc., the lender cannot become involved in those disputes, so you need to be sure you are comfortable with the company you choose. Do a good job of checking references and company ratings to be certain you will be happy with the terms and the job results before you begin any work with any contractor and that you are certain your loan will be granted, and you can pay for the work you authorize before you begin.

| Marshall P. August 7th, 2021 |

My home should appraise at $300,000. I owe $165 ,000.If I were to get a reverse mortgage and borrow no money or pay no payments which I understand is one benefit then after 10 years ,would I owe more than I presently owe since no money was borrowed other than the preset mortgage amount plus closing .If this would be the case then Could I get a conventional mortgage at some time and pay the reverse mortgage off .Point would be ,10 years without a payment and revert back to a similar mortgage that I now have or sell the house for market price ..77 years old and only want to be payment free.

| Michael Branson August 10th, 2021 |

If I could answer this question with any degree of certainty, I would be a very wealthy man! Unfortunately, a lot of this depends on future events and I cannot tell you what will happen in the future.

If I run the criteria you provided through the HUD calculator, it tells me that in 10 years you will have a loan balance of $237,920 against a property valued at $444,073 which would give you about $206,153 equity at that time. But there is a big problem with that, the calculator can only estimate the numbers based on today's known facts. It uses today's interest rates, and it uses 4% per year appreciation.

The interest rate it uses to determine the interest accrual is the 10-year rate and that is higher than the actual accrued interest at the start of the loan, but no one can tell you what future rates will be or when they will change. Most people I know (including myself) preferred fixed interest rates but those who received the adjustable-rate reverse mortgages have done so much better and have accrued so much less interest over the past 15 years than those who took the higher fixed rates.

Will that continue to be the case? No one knows for sure. Will the properties appreciate at 4% per year or continue as they are now at 10% or higher in many parts of the country? According to the National Association of Realtors, Prices in March were up over 17% from a year earlier. Those kinds of results would skew the HUD calculator model just as would a sudden drop.

So I guess the bottom line is that after more than 45 years in mortgage banking, the best I can tell you about rates and values is that they will either go up, down or stay the same! Since that is the case, I could never give you any kind of solid answer about whether you would have the equity to refinance into a conventional loan after 10 years or not.

What I can tell you is that you can live the rest of your life in the home with a reverse mortgage if you continue to pay your taxes and insurance on time and maintain the home in a reasonable manner, regardless of what the equity does later. I can tell you that there is never a prepayment penalty so you can choose to sell your home at any time if that is your choice and sell without a penalty.

I can tell you that if you want to make payments so that the balance does not rise as the interest accrues, while you are never required to do so, you can at any time and in any amount.

And finally, I can tell you that if you do live in the home until you pass and the balance of the loan is much greater than the value of the home, your heirs can keep the home and pay off the loan at the lower of the amount owed or 95% of the current appraised value, or they can walk away and owe nothing.

I can tell you those things because they are constant and do not change based on the interest rates or the appreciation the home experiences. After that, no lender, forward or reverse, can tell you what the future will bring.

| Janet V. June 16th, 2021 |

I've had a recent mortgage for 8 years.my husband passed 2 years ago. I've kept all the requirements up however I have credit card debt and I'm sure there are judgments coming. Florida Is a homestead state however, can a civil judgment be a problem with my Reverse Mortgage? Should I consider bankruptcy or is that worse?

| Michael Branson June 18th, 2021 |

A judgement will not affect a current reverse mortgage. If you keep your taxes, insurance, and any other property charges current, you will be ok.

Any judgement filed would be filed after the reverse mortgage and therefore secondary to the mortgage loan so it is not a concern to the lender.

A bankruptcy (BK) could interrupt any payments you currently receive from the loan. The BK would not cause the lender to call the loan due and payable either, but it would require the lender to cease making any payments to you until the BK court exempted the property/loan from the BK.

As always, we cannot give you legal advice and since you are contemplating both actions, I would strongly suggest that you run both by your attorney for legal advice on the actions and how they will affect you in your circumstances.

| Julie M. June 1st, 2021 |

I'm in the process of getting a reverse mortgage on my duplex. I was just recently told that I would have to be occupying the larger unit to qualify. Is this true? I've always used the larger unit for rental income.

| Michael Branson June 2nd, 2021 |

That is the HUD requirement whenever there is more than one unit involved. In all honesty, I really do not understand the rationale behind this requirement, especially when you are talking about a true duplex and not just an accessory dwelling unit (ADU) where the ADU is just a mother-in-law type unit that is much smaller than the main dwelling, but it is HUD's program and their requirement.

When the second unit is a fully functioning duplex unit that suits the owner's needs and in some cases, even better than the larger unit, I believe HUD should allow the owner to live in the smaller unit but it is HUD's requirement for the reverse mortgage program that the owner occupy the larger unit.

| Allen L. November 25th, 2020 |

B) if my home is appraised to sell at $213000 and my current loan is $125000 can I still obtain a reverse mortgage